Table of Contents

MISCELLANEOUS

Delivery of Documents to Stockholders Sharing an Address

If you are the beneficial owner, but not the record holder, of shares of our common stock, your broker, bank, trust or other nominee may only deliver one copy of this proxy statement and the 20182020 Form 10-K, which serves as our Annual Report to Stockholders under Regulation 14A (the "2018"2020 Annual Report"), to multiple stockholders who share an address unless that nominee has received contrary instructions from one or more of the stockholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy statement and the 20182020 Annual Report to a stockholder at a shared address to which a single copy of the documents was delivered. A stockholder who wishes to receive a separate copy of the proxy statement and annual report, now or in the future, should submit this request to our investor relations department through the Investor Relations page of our website at www.exlservice.com.https://ir.exlservice.com/. Beneficial owners sharing an address who are receiving multiple copies of proxy materials and annual reports and who wish to receive a single copy of such materials in the future will need to contact their broker, bank, trust or other nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future.

Electronic Access to Proxy Statement and Annual Report

This proxy statement and our 20182020 Annual Report may be viewed on our website atwww.exlservice.com and atwww.proxyvote.com by following the instructions provided in the Internet Notice. If you are a stockholder of record, you can elect to access future annual reports and proxy statements electronically by marking the appropriate box on your proxy form. If you choose this option, you will receive a proxy form in mid-May listing the website locations and your choice will remain in effect until you notify us by mail that you wish to resume mail delivery of these documents. If you hold your common stock through a bank, broker or another holder of record, refer to the information provided by that entity for instructions on how to elect this option.

Table of Contents

ANNUAL MEETING Q&A

WHO IS PROVIDING THIS PROXY STATEMENT? |

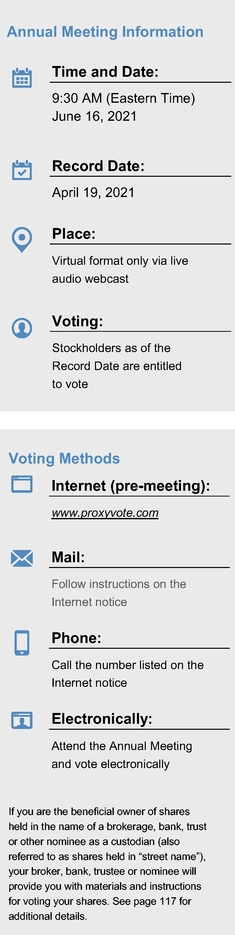

This Proxy Statement is being furnished to you in connection with the solicitation by the board of directors of ExlService Holdings, Inc., a Delaware corporation ("us," "we," "our" or the "Company"), of proxies to be used at our 2021 Annual Meeting of Stockholders (the "Annual Meeting") to be held in virtual format only via live audio webcast at the website www.virtualshareholdermeeting.com/EXLS2021 on June 16, 2021 at 9:30 AM, Eastern Time, and any adjournments or postponements thereof.

HOW ARE THE PROXY MATERIALS BEING MADE AVAILABLE? |

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), instead of mailing a printed copy of our proxy materials to each stockholder of record, the Company furnishes proxy materials via the Internet. If you received a Notice of Internet Availability of Proxy Materials (the "Internet Notice") by mail, you will not receive a printed copy of our proxy materials other than as described herein. Instead, the Internet Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Internet Notice also instructs you as to how you may submit your proxy over the Internet or by phone. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting proxy materials included in the Internet Notice.

Our Notice of Annual Meeting, proxy statement and form of proxy card are each available at www.proxyvote.com. You may access these materials and provide your proxy by following the instructions provided in the Internet Notice.

WHEN WILL THE INTERNET NOTICE BE SENT? |

We anticipate the Internet Notice will be sent to stockholders on or about April 23, 2021. This proxy statement and the form of proxy relating to the Annual Meeting will be made available via the Internet to stockholders on or prior to the date that the Internet Notice is first sent.

Only stockholders who own shares of our common stock at the close of business on April 19, 2021, the record date for the Annual Meeting, can vote at the Annual Meeting. As of the close of business on April 19, 2021, the record date, we had 33,479,956 shares of common stock outstanding and entitled to vote. Each holder of common stock is entitled to one vote for each share held as of the record date for the Annual Meeting.

IS CUMULATIVE VOTING APPLICABLE IN THE ELECTION OF DIRECTORS? |

There is no cumulative voting in the election of directors.

If your shares are registered directly in your name with Computershare Trust Company, N.A., our transfer agent (which means you are a "stockholder of record"), you can vote your proxy by (i) Internet, (ii) by phone or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. Please refer to the specific instructions set forth in the Internet Notice.

If you are the beneficial owner of shares held in the name of a brokerage, bank, trust or other nominee as a custodian (also referred to as shares held in "street name"), your broker, bank, trustee or nominee will provide you with materials

Table of Contents

ANNUAL MEETING Q&A

and instructions for voting your shares. In addition to voting by mail, a number of banks and brokerage firms participate in a program provided through Broadridge Financial Solutions, Inc. ("Broadridge") that offers telephone and Internet voting options. Votes submitted by telephone or by using the Internet through Broadridge's program must be received by 11:59 p.m. Eastern Time, on June 15, 2021.

You also have the right to vote electronically at the Annual Meeting if you decide to attend. Our board of directors recommends that you vote by Internet, phone or mail even if you choose to attend the Annual Meeting. If you are a "stockholder of record," you may vote your shares electronically at the Annual Meeting. If you hold your shares in "street name," you must obtain a proxy from your broker, bank, trustee or nominee giving you the right to vote the shares electronically at the Annual Meeting or your vote at the Annual Meeting will not be counted.

You will not be able to vote your shares unless you use one of the methods described above to designate a proxy or you vote electronically at the Annual Meeting.

You can revoke your proxy at any time before it is exercised in any of the following ways:

- •

- by voting at the Annual Meeting;

- •

- by submitting written notice of revocation to the inspector of elections prior to the Annual Meeting; or

- •

- by submitting another properly executed proxy of a later date to the inspector of elections prior to the Annual Meeting.

HOW IS A QUORUM ESTABLISHED AT THE ANNUAL MEETING? |

A quorum, which is a majority of the issued and outstanding shares of our common stock as of the record date of April 19, 2021, must be present, in person or by proxy, to conduct business at the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending the Annual Meeting in person and by their proxy holders.

If you indicate an abstention as your voting preference for all matters to be acted upon at the Annual Meeting, your shares will be counted toward a quorum but they will not be voted on any matter. Virtual attendance at our Annual Meeting constitutes presence in person for purposes of quorum at the Annual Meeting.

WHAT IS A "BROKER NON-VOTE" |

If you are the beneficial owner of shares held in "street name" by a broker, then your broker, as the record holder of the shares, must vote those shares in accordance with your instructions. If you fail to provide instructions to your broker, under the New York Stock Exchange rules (which apply to brokers even though our shares are listed on the NASDAQ Stock Market), your broker will not be authorized to vote your shares on "non-routine" proposals, which include, at the Annual Meeting, the election of directors and approval on an advisory (non-binding) basis of the compensation of our named executive officers. As a result, a "broker non-vote" occurs. However, without your instructions, your broker has discretionary authority to vote your shares with respect to "routine" proposals only, which include, at the Annual Meeting, the ratification of the appointment of our independent registered public accounting firm.

HOW MANY VOTES ARE NEEDED TO APPROVE EACH PROPOSAL AND WHAT IS THE EFFECT OF ABSTENTIONS AND/OR BROKER NON-VOTES? |

Proposal 1: Election of Directors

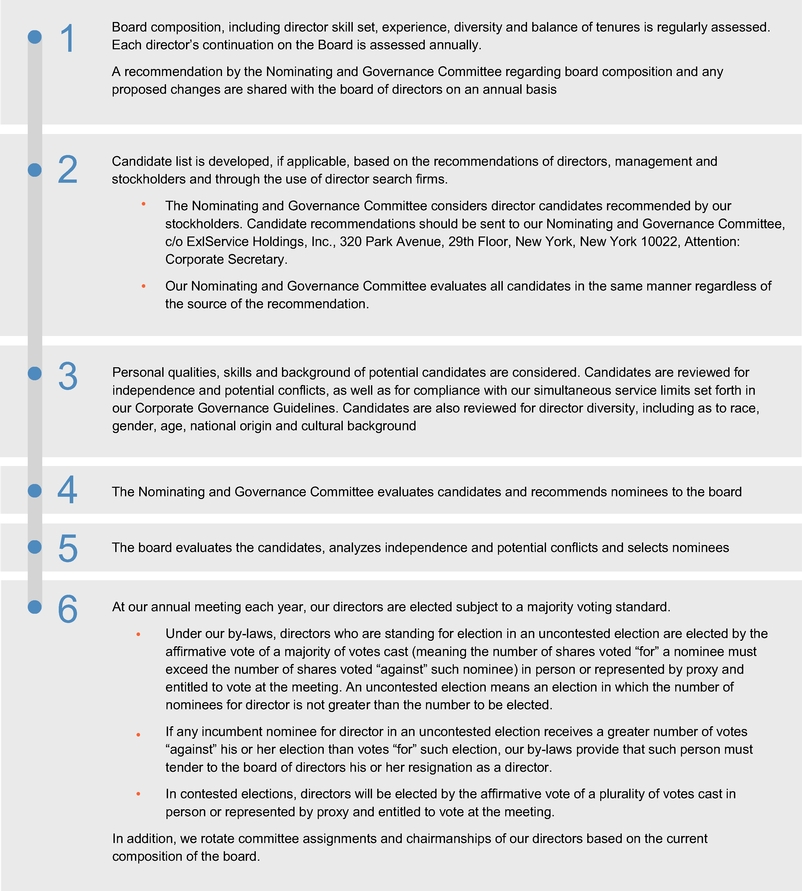

Under our Fifth Amended and Restated By-Laws (our "by-laws"), directors who are standing for election at the Annual Meeting will be elected by the affirmative vote of a majority of votes cast (meaning the number of shares voted "for" a

Table of Contents

ANNUAL MEETING Q&A

nominee must exceed the number of shares voted "against" such nominee) by stockholders in person or represented by proxy and entitled to vote at the Annual Meeting. If any incumbent nominee for director receives a greater number of votes "against" his or her election than votes "for" such election, our by-laws provide that such person will tender to the board of directors his or her resignation as a director. You may cast your vote in favor of electing all of the nominees as directors, against one or more nominees, or abstain from voting your shares. For purposes of the vote on Proposal 1, abstentions and broker non-votes will have no effect on the results of the vote. Virtual attendance at our Annual Meeting will constitute presence in person for purposes of voting at the Annual Meeting.

Other Proposals

The ratification of the appointment of our independent registered public accounting firm, the advisory (non-binding) approval of the compensation of our named executive officers and each other item to be acted upon at the Annual Meeting will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. You may cast your vote in favor of or against these proposals or you may abstain from voting your shares. For purposes of the vote on Proposal 2 (ratification of the appointment of our independent registered public accounting firm), Proposal 3 (advisory (non-binding) vote on executive compensation), and such other items properly presented and to be acted upon at the Annual Meeting, abstentions will have the effect of a vote against these proposals. Broker non-votes will have the effect of a vote against Proposal 3, but because Proposal 2 is a "routine" proposal where brokers have discretionary authority to vote in the absence of instruction, there will be no broker non-votes.

If you submit your proxy, but do not mark your voting preference, the proxy holders will vote your shares (i) FOR the election of all six nominees for director, (ii) FOR the ratification of the appointment of our independent registered public accounting firm, (iii) FOR the approval on an advisory (non-binding) basis of the compensation of our named executive officers, and (iv) as described below, in the judgment of the proxy holder on any other matters properly presented at the Annual Meeting.

ARE THERE OTHER MATTERS TO BE ACTED UPON AT THE MEETING? |

Our board of directors presently is not aware of any matters, other than those specifically stated in the Notice of Annual Meeting, which are to be presented for action at the Annual Meeting. If any matter other than those described in this proxy statement is presented at the Annual Meeting on which a vote may properly be taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

WHAT ABOUT ADJOURNMENTS AND POSTPONEMENTS? |

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting is properly adjourned or postponed.

WHO PAYS FOR SOLICITATION OF PROXIES? |

We will pay the cost of printing and mailing proxy materials and posting them on the Internet. Upon request, we will reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of our common stock.

HOW CAN I ATTEND THE ANNUAL MEETING AND WHY IS THE COMPANY HOLDING THE ANNUAL MEETING IN A VIRTUAL ONLY FORMAT? |

We have monitored the pandemic closely and have determined that holding an in-person annual meeting could pose a risk to the health and safety of our stockholders, employees, and directors, and therefore we will instead hold a virtual Annual Meeting rather than a meeting in New York or at any physical location.

Table of Contents

ANNUAL MEETING Q&A

To attend and participate in the Virtual Annual Meeting, stockholders will need to access the live audio webcast of the meeting. To do so, stockholders of record will need to visit www.virtualshareholdermeeting.com/EXLS2021 and use their 16-digit Control Number provided in the Internet Notice to log in to this website, and beneficial owners of shares held in street name will need to follow the instructions provided by the broker, bank or other nominee that holds their shares. We encourage stockholders to log in to this website and access the webcast before the Annual Meeting's start time. Further instructions on how to attend, participate in and vote at the Annual Meeting, including how to demonstrate your ownership of our stock as of the record date, are available at www.virtualshareholdermeeting.com/EXLS2021. Please note you will only be able to attend, participate and vote in the meeting using this website. All references to attending the Annual Meeting "in person" in this Proxy Statement shall mean attending the live webcast at the Annual Meeting.

HOW DO I SUBMIT QUESTIONS AT THE ANNUAL MEETING? |

We are committed to ensuring that our stockholders will be afforded the same rights and opportunities to participate in a virtual Annual Meeting as they would at a meeting held at a physical location. You will be able to submit questions during our Annual Meeting by visiting www.virtualshareholdermeeting.com/EXLS2021. We will try to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct as determined by the chairman of the meeting. However, we reserve the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

WILL THE ANNUAL MEETING BE RECORDED? |

A recording of the Annual Meeting will be available online at http://ir.exlservice.com for approximately 12 months following the meeting date.

WHAT IF I HAVE TECHNICAL DIFFICULTIES OR TROUBLE ACCESSING THE VIRTUAL ANNUAL MEETING? |

We will have technicians ready to assist you with any technical difficulties you may have accessing the live webcast of the Annual Meeting. A technical support phone number will be posted on www.virtualshareholdermeeting.com/EXLS2021 that you may call if you experience technical difficulties during the check-in process or during the Annual Meeting.

WHAT IF I HAVE FURTHER QUESTIONS? |

If you have any further questions about voting your shares or attending the Annual Meeting, please call our Investor Relations Department at (212) 624-5913.

Please promptly vote and submit your proxy before the Annual Meeting by (i) Internet (by following the instructions provided in the Internet Notice), (ii) by phone (by following the instructions provided in the Internet Notice) or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. This will not limit your right to attend or vote at the Annual Meeting.

Table of Contents

OTHER MATTERS

Our board of directors does not know of any other business that will be presented at the Annual Meeting. If any other business is properly brought before the Annual Meeting, your proxy holders will vote on it as they think best unless you direct them otherwise in your proxy instructions.

Whether or not you intend to be present at the Annual Meeting, we urge you to submit your signed proxy promptly.

| | |

|

|

By Order of the Board of Directors, |

|

|

Ajay Ayyappan

Senior Vice President, General Counsel

and Corporate Secretary |

By Order of the Board of Directors,

Ajay Ayyappan

Senior Vice President, General Counsel and Corporate Secretary

New York, New York

April 26, 201923, 2021

We will furnish without charge to each person whose proxy is being solicited, upon the written request of any such person, a copy of the 20182020 Form 10-K, as filed with the SEC, as well as copies of exhibits to the 20182020 Form 10-K, but for copies of exhibits will charge a reasonable fee per page to any requesting stockholder. Stockholders may make such request in writing to ExlService Holdings, Inc., 320 Park Avenue, 29th29th Floor, New York, New York 10022, Attention: Investor Relations. The request must include a representation by the stockholder that as of April 18, 2019,19, 2021, the stockholder was entitled to vote at the Annual Meeting.

Table of Contents

Annex A

CERTIFICATE OF AMENDMENT

TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

EXLSERVICE HOLDINGS, INC.

I, the undersigned, being the officer designated by the board of directors to execute this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of ExlService Holdings, Inc. (the "Corporation"), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware do hereby certify:

FIRST: By unanimous written consent of the Board of Directors of ExlService Holdings, Inc., filed with the Corporation, resolutions were duly adopted setting forth a proposed amendment to the Amended and Restated Certificate of Incorporation, as amended, of said corporation, declaring said amendment to be advisable and directing that the amendment be considered at the next annual meeting of the stockholders of said corporation.

The text of the Amended and Restated Certificate of Incorporation is as set forth in such resolution is as follows:

1. The first paragraph ofSection 6.2 of the Amended Restated Certificate of Incorporation, as amended, is hereby amended and restated in its entirety to read as follows:

"Terms of Directors. Subject to the provisions of this Certificate of Incorporation relating to directors elected by the holders of one or more series of Preferred Stock, voting as a separate series or with one or more other series of Preferred Stock, at each annual meeting of stockholders commencing with the 2019 annual meeting of stockholders, directors of the corporation other than those in the 2020 Class and 2021 Class (each as defined below) shall be elected for a term of one year, expiring at the next succeeding annual meeting of stockholders. Each director of the corporation who was elected at the 2017 annual meeting of stockholders for a three-year term expiring in 2020 (the "2020 Class"), and each director of the corporation who was elected at the 2018 annual meeting of stockholders for a three-year term expiring in 2021 (the "2021 Class"), including any person appointed to fill any vacancy occurring with respect to any director in the 2020 Class or the 2021 Class (each of whom shall be deemed to be a member of the class of directors in which the vacancy occurred), shall continue to hold office until the end of the term for which such director was elected or appointed, as applicable. Subject to the provisions of this Certificate of Incorporation relating to directors elected by the holders of one or more series of Preferred Stock, voting as a separate series or with one or more other series of Preferred Stock, (a) commencing with the 2020 annual meeting of stockholders, all directors of the corporation other than those in the 2021 Class will be elected for a term of one year, and (b) commencing with the 2021 annual meeting of stockholders, all directors of the corporation will be elected for a term of one year. In all cases, each director shall serve until such director's successor has been duly elected and qualified or until such director's earlier death, disqualification, resignation or removal."

SECOND: That said amendments were duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware. The foregoing amendments shall be effective upon filing with the Secretary of State of the State of Delaware.

VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M.p.m. Eastern Time on June 16, 2019.15, 2021. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. EXLSERVICE HOLDINGS, INC. 320 PARK AVENUE, 29th FLOOR NEW YORK, NEW YORK 10022 During The Meeting - Go to www.virtualshareholdermeeting.com/EXLS2021 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M.p.m. Eastern Time on June 16, 2019.15, 2021. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: E75473-P24645D42591-P53778 KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. EXLSERVICE HOLDINGS, INC. The Board of Directors recommends you vote FOR proposalthe following: 1. Election of Directors Nominees: For Against Abstain ! ! ! 1. The amendment of the Company's amended and restated certificate of incorporation to effect a phased declassification of the board of directors over the next three years For Against Abstain! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 1a. Garen Staglin The Board of Directors recommends you vote FOR the following:proposals 2 and 3. For Against Abstain ! ! ! 4.1b. Rohit Kapoor 2. The ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for fiscal year 2021. 1c. Anne Minto ! ! ! 1d. Som Mittal 3. The approval, on a non-binding advisory basis, of the compensation of the named executive officers of the Company 2. Election of Directors Nominees: For Against AbstainCompany. 1e. Clyde Ostler 1f. Vikram Pandit NOTE: The proxies are authorized to act upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof ! ! ! ! ! ! ! ! ! 2a. Rohit Kapoor 2b. Anne Minto 2c.thereof. 1g. Kristy Pipes 1h. Nitin Sahney 1i. Jaynie Studenmund The Board of Directors recommends you vote FOR proposals 3 and 4. ! ! ! 3. The ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for fiscal year 2019 Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com. E75474-P24645D42592-P53778 EXLSERVICE HOLDINGS, INC. Annual Meeting of Shareholders June 17, 2019 8:16, 2021 9:30 A.M.AM EDT This proxy is solicited by the Board of Directors The shareholder(s) hereby appoint(s) Vishal ChhibbarMaurizio Nicolelli and Ajay Ayyappan, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of commonCommon/Preferred stock of EXLSERVICE HOLDINGS, INC. that the shareholder(s) is/are entitled to vote at the Annual Meeting of Shareholders to be held virtually via live audio webcast at 8:www.virtualshareholdermeeting.com/EXLS2021, at 9:30 A.M., Eastern Daylight Time on June 17, 2019, at 320 Park Avenue, 29th Floor, New York, New York 10022,16, 2021, and any adjournment or postponement thereof. The undersigned hereby also authorize(s) the proxy, in his or her discretion, to vote on any other business that may properly be brought before the meeting or any adjournment or postponement thereof to the extent authorized by Rule 14a-4(c) promulgated by the Securities and Exchange Commission. The undersigned herby acknowledges receipt of the notice of Annual Meeting of Shareholders, dated on or about April 23, 2021, and the Proxy Statement furnished therewith. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations, and accordingly, will be voted FOR each of the Board of Directors’Directors' nominees for director specified in Proposal 2,1 and FOR Proposals 1,2 and 3, and 4, unless a contrary choice is specified, in which case the proxy will be voted as specified. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders, dated on or about April 26, 2019, and the Proxy Statement furnished therewith. Continued and to be signed on reverse side